Coca-Cola Europacific Partners Q1 2025 Update: Revenue Growth Amid Volume Challenges

Coca-Cola Europacific Partners PLC Q1 2025 Trading Update: A Comprehensive Analysis

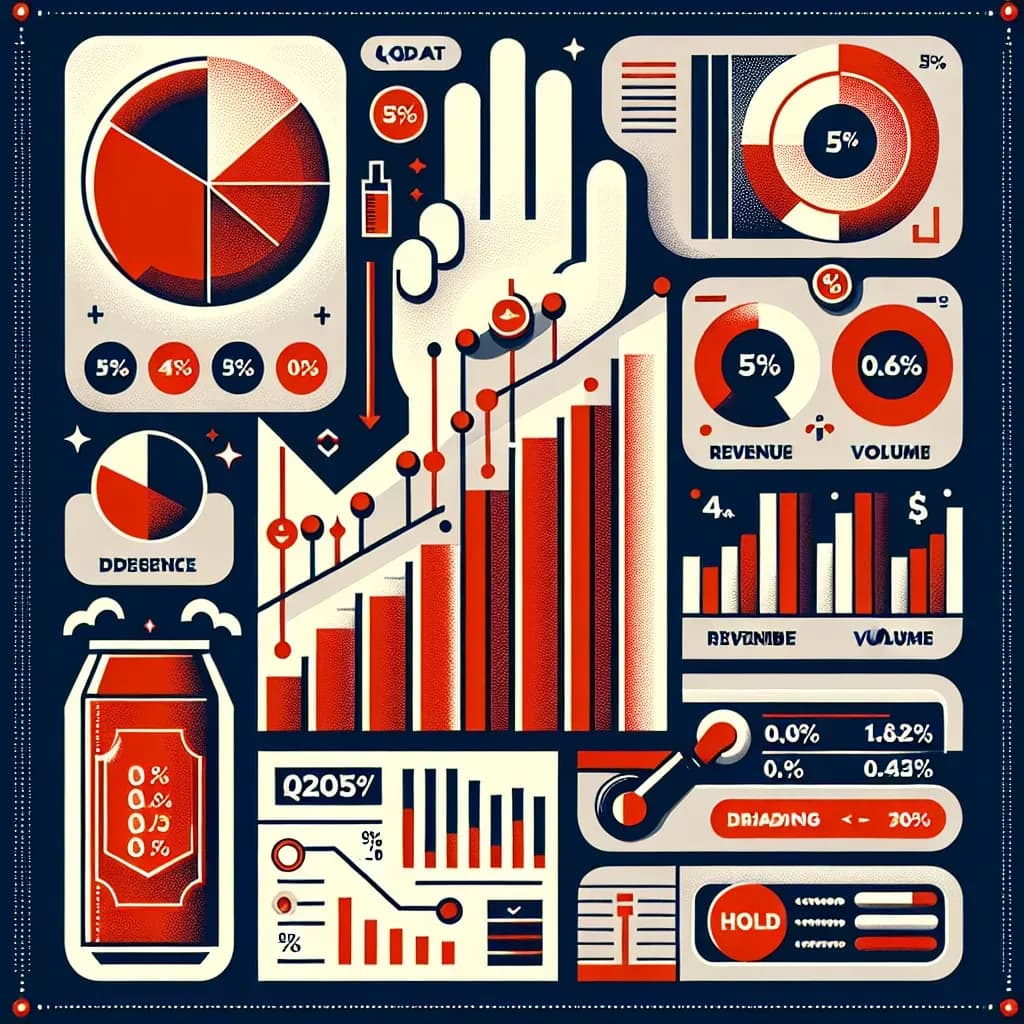

Stock Recommendation: Hold Coca-Cola Europacific Partners PLC (CCEP) has reported mixed results in its Q1 2025 trading update, reflecting both growth opportunities and challenges. While revenue growth remains positive, volume declines highlight the need for strategic adjustments. Investors should adopt a cautious stance while monitoring the company's efforts to improve its market position.

Key Insights from the Report

- Total Revenue: €4,689 million, up 5.0% from €4,465 million in Q1 2024.

- Adjusted Comparable Revenue: Declined by 0.8%, indicating underlying challenges despite reported growth.

- Adjusted Comparable Volume: Decreased by 0.6%, with Europe down 2.1% and Australia/Pacific (APS) up 2.1%.

- Revenue per Unit Case (UC): Increased by 3.1% to €5.25.

- Dividend: Interim dividend declared at €0.79 per share, maintaining a payout ratio of approximately 50% for FY25.

Detailed Analysis

Revenue Growth vs. Volume Decline

CCEP's revenue growth of 5.0% is commendable, primarily driven by effective pricing strategies that resulted in a 3.1% increase in revenue per unit case. However, the decline of 0.6% in adjusted comparable volume is concerning and signals a potential shift in consumer preferences or market dynamics.

Volume declines were most notable in Europe, where strategic de-listings and seasonal factors, including Easter timing, had an adverse impact. The 2.1% increase in the APS region, driven by strong performances from brands like Monster and Fanta, contrasts sharply with the European experience, emphasizing regional disparities in performance.

Segment Performance Insights

- Coca-Cola Classic: Experienced a decline of -2.0% due to a strong comparative base from Q1 2024 (+4.4%). The brand has faced pressure in Europe, balancing out growth in emerging markets like the Philippines.

- Coca-Cola Zero Sugar: A highlight of the report with growth of +4.0%, benefiting from effective execution and innovation across Europe and APS.

- Flavours & Mixers: Slight decline of -1.3%, with brands such as Sprite and Fanta facing challenges despite new product launches.

- Water & Sports Drinks: Growth in water (+3.5%) reflects market resilience, but RTD Tea & Coffee's decline of -9.9% points to a need for renewed focus in this category.

- Energy Segment: Boosted by a significant +11.9% growth in other income from Monster Energy products, highlighting a strong performance in this competitive segment.

Geographic Performance

- Europe: Revenue decreased by 1.1% to €3,253 million, attributed to volume declines and strategic de-listings.

- Australia/Pacific: Revenue growth driven by strong brand performance, particularly in energy drinks.

- Southeast Asia: Continued share gains in the Philippines, although Indonesia struggled due to macroeconomic conditions.

Strategic Moves and Sustainability

CCEP's commitment to sustainability is evident as it retains its position on the Carbon Disclosure Project's A List for Climate for the ninth consecutive year. Investments in AI technology for sustainability improvements and the introduction of a new returnable glass bottle line in France reflect the company's forward-thinking approach.

Challenges Ahead

Mid-single-digit volume declines and the impact of increased sugar taxes present ongoing challenges. The shift in selling days also contributed to a decrease of approximately 25 million unit cases, necessitating a keen focus on operational execution and market adaptation.

Market Context and Competitive Landscape

The broader macroeconomic environment remains complex, with rising costs and changing consumer habits influencing the beverage industry. CCEP competes with other industry giants like PepsiCo and Nestlé, which are also navigating similar challenges. The emphasis on health-conscious products and sustainability initiatives will likely dictate market positioning in the coming months.

Future Outlook

While CCEP's revenue growth is promising, the company must address its volume challenges to sustain momentum. Continued focus on strategic pricing, product innovation, and effective marketing will be crucial. Investors should keep an eye on how CCEP adapts its strategies in response to consumer trends and competitive pressures.

Conclusion

Coca-Cola Europacific Partners PLC's Q1 2025 trading update reveals a company at a crossroads, experiencing growth alongside significant challenges. While the revenue trajectory is positive, the decline in volume and mixed segment performance warrant a cautious approach. Recommendation: Hold, as CCEP navigates its current landscape and strives for improved performance in the months ahead. Investors should remain vigilant to the evolving market dynamics that will shape the company's future.