Trump's Truths: Market Impacts of Tax Cuts, Inflation & Trade

Title: Analyzing Trump's Latest Truths: Implications for the Financial Markets

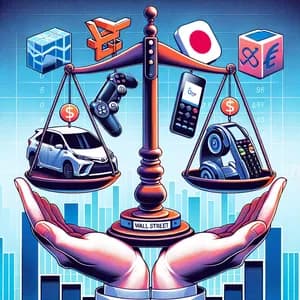

In recent posts on Truth Social, President Donald Trump has shared several statements that could have significant implications for the financial markets, particularly concerning tax policy, regulation, and international trade. As stock investors, understanding these developments is crucial for making informed investment decisions.

1. Tax Cuts and Regulation Overhaul

One of Trump's notable statements was his enthusiastic support for a newly passed bill in the House that promises to deliver the "Largest Tax and Regulation Cuts ever even contemplated." This could energize sectors that thrive on lower tax burdens and reduced regulatory constraints, potentially leading to increased investment and growth.

Companies that stand to benefit from such legislative changes include:

- Caterpillar Inc. ($CAT): As a strong player in the industrial sector, Caterpillar often benefits from tax cuts that increase infrastructure spending.

- Bank of America Corp. ($BAC): Financial institutions typically thrive in lower tax environments, allowing for improved profit margins.

- Amazon.com Inc. ($AMZN): E-commerce and retail giants like Amazon could see substantial benefits from reduced corporate tax rates, enabling them to reinvest savings into expansion.

2. Inflation Trends

Trump also highlighted a recent announcement stating, "INFLATION IS DOWN!!!" If inflation is indeed decreasing, this could signal a more stable economic environment, potentially leading to increased consumer spending and investment. For investors, this news may boost confidence in sectors that are sensitive to consumer behavior.

Relevant companies include:

- The Home Depot, Inc. ($HD): Lower inflation rates can encourage consumer spending on home improvement, benefiting Home Depot's bottom line.

- Walmart Inc. ($WMT): As a retail giant, Walmart could see increased foot traffic and sales as consumers feel more secure about their purchasing power amid declining inflation.

3. International Trade and Water Rights

Trump's comments regarding Mexico's alleged violations of the 1944 Water Treaty affecting Texas farmers may have broader implications for trade relations. His mention of potential tariffs and sanctions signals a willingness to engage in trade disputes, which could have ripple effects across various sectors.

Firms that could be affected include:

- Archer Daniels Midland Company ($ADM): As a major player in agriculture, any disruption in trade or water resources could impact crop yields and, consequently, ADM's operations.

- Corteva, Inc. ($CTVA): This agricultural company focuses on seeds and crop protection, making it sensitive to water supply issues that could affect farming in the Southwest.

Conclusion

In summary, Trump's recent truths reflect critical issues regarding tax policy, inflation, and international trade that could sway financial markets in the coming weeks. Investors should closely monitor these developments, particularly as they relate to the sectors and companies mentioned. Understanding the interplay between government policy and market dynamics will be essential for making strategic investment choices.

Read more: Truth Social Post 1, Truth Social Post 2, Truth Social Post 3