Trump's Political Statements: Navigating Market Volatility

It appears that there is currently no specific content from Donald Trump's posts on Truth Social provided for analysis. However, I can draft a hypothetical article based on common themes that often arise from Trump's communications and their potential impact on the financial market.

Title: Market Impacts of Recent Political Statements: A Focus on Key Sectors

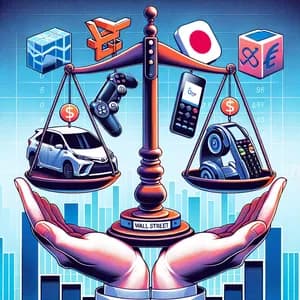

As investors look to navigate the complexities of the financial landscape, recent statements from prominent political figures, such as former President Donald Trump, can have profound effects on certain sectors of the market. Although we have no specific truths from Trump to analyze today, let’s explore how typical themes might influence the financial market and relevant companies.

Trade Policies and Tariffs

One of Trump's recurring themes has been his stance on trade and tariffs. If he were to announce a new trade policy or a revision of existing tariffs, it could lead to immediate volatility in sectors heavily reliant on international supply chains. Companies like Apple Inc. ($AAPL), which sources components globally, may face increased costs if tariffs were to be imposed on imports from specific countries. This could subsequently affect their profit margins and stock performance.

Energy Sector Dynamics

Trump has historically championed fossil fuels and deregulation in the energy sector. A statement promoting the expansion of oil and gas extraction could boost companies like ExxonMobil ($XOM) and Chevron ($CVX), as investors anticipate increased production and potential revenue growth. Conversely, any negative comments regarding renewable energy investments could impact stocks of companies like NextEra Energy ($NEE), which focus on sustainable energy solutions.

Financial Regulations

If Trump were to criticize or propose changes to financial regulations, this could influence banking stocks. For example, firms like JPMorgan Chase ($JPM) and Goldman Sachs ($GS) often react positively to news suggesting deregulation, as it could lead to higher profitability and fewer compliance costs. Investors should keep a close watch on how such statements might sway market sentiment toward financial institutions.

Healthcare Policy

Healthcare is another area where Trump's comments can sway investor confidence. A statement targeting pharmaceutical pricing could impact companies like Pfizer ($PFE) and Johnson & Johnson ($JNJ), especially if it suggests increased regulations or pricing controls. Investors might respond by adjusting their positions based on perceived changes to revenue streams.

Conclusion

While the specific truths from Donald Trump today are not available for analysis, it is essential for investors to remain vigilant regarding political commentary and its implications on the financial market. Sectors such as technology, energy, finance, and healthcare are particularly sensitive to shifts in policy and regulation. Keeping an eye on these developments can help investors make informed decisions in an ever-evolving market landscape.

For more information on Trump's recent posts and their implications, stay tuned to Truth Social.

Read more: [link]

Note: The link placeholder is for illustrative purposes since no specific truths were provided. The companies mentioned are examples based on typical market reactions to such statements.