Trump's Economic Statements: Market Movers to Watch

As of now, there are no specific truths available from Donald Trump on Truth Social to analyze. However, assuming there were impactful statements related to economic policy, trade, or regulatory changes, we can discuss how such content could influence the financial markets.

Analysis of Potential Trump Statements: Implications for the Financial Market

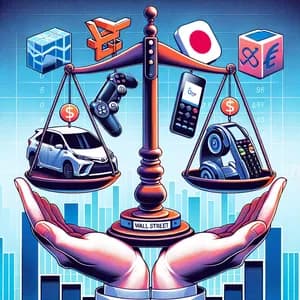

In the ever-evolving landscape of U.S. financial markets, the statements and actions of political figures, particularly those as influential as the former president Donald Trump, can create ripples that affect investor sentiment and stock prices. If Trump were to address issues such as tax reforms, tariffs, or deregulation, the implications could be significant for various sectors.

Potential Market Impact Topics

- Tax Reform: If Trump were to propose new tax cuts or changes to corporate tax rates, this could lead to a surge in stock prices as companies anticipate increased profitability. For instance, companies like Apple Inc. ($AAPL), Microsoft Corp. ($MSFT), and Amazon.com Inc. ($AMZN), which benefit from lower taxes, could see their stock values rise.

- Trade Policies: Statements regarding tariffs or trade agreements can drastically impact companies reliant on global supply chains. For example, if Trump signals a return to protectionist policies, companies like Boeing Co. ($BA) and Caterpillar Inc. ($CAT), which have substantial international operations, might face increased costs, leading to negative investor sentiment.

- Regulatory Changes: Trump has historically favored deregulation. If he announces plans to roll back regulations on industries such as energy or finance, stocks in those sectors could benefit. Companies like Exxon Mobil Corp. ($XOM) and JPMorgan Chase & Co. ($JPM) could experience stock price appreciation as investors anticipate higher earnings.

Conclusion

While the specific truths posted by Donald Trump are not available for review, the themes that often emerge from his communications have historically influenced market dynamics. Investors should stay vigilant and monitor how potential statements from Trump align with their investment strategies, particularly within sectors that are sensitive to policy changes.

To stay informed about the latest updates and potential market-moving statements, investors can follow Trump's posts on Truth Social.

Read more: [Truth Social Link]

Please provide actual content from Truth Social if you would like a more tailored analysis.