Tesla's Leadership Shake-Up: What Musk's Pay Deal Rejection Means for Investors

The Impact of Tesla's Leadership Decisions on Stock Investors

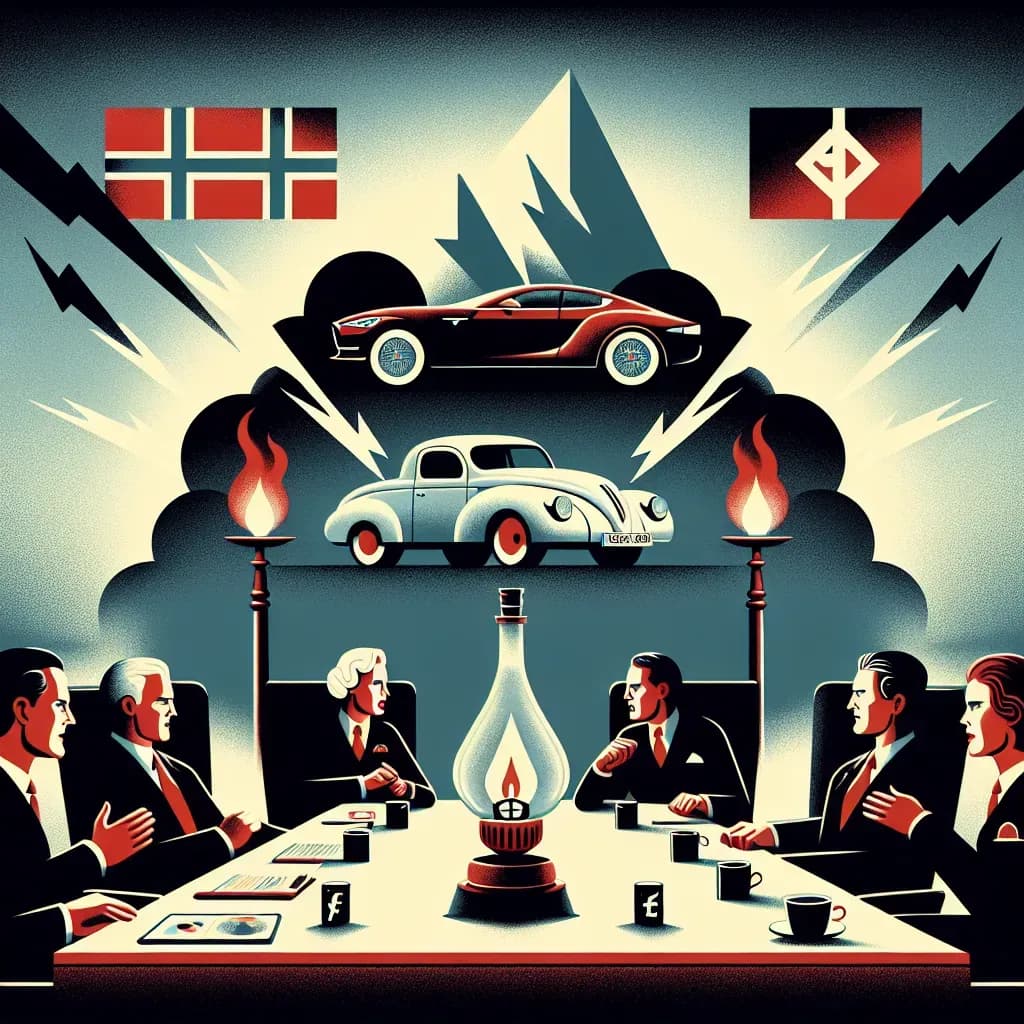

As stock investors, we are constantly analyzing the decisions made by corporate leaders and their potential impact on company valuations and market sentiment. One of the most talked-about topics in the financial news recently has been the rejection of Elon Musk’s proposed $1 trillion pay deal by Norway’s sovereign-wealth fund, one of Tesla's ($TSLA) major investors. This decision raises important questions about executive compensation, investor confidence, and the long-term outlook for Tesla.

Musk's compensation package, which is contingent upon achieving ambitious performance targets, has been a topic of debate since its inception. While proponents argue that it aligns Musk's interests with those of shareholders, critics point out that the scale of the package may be excessive, especially in light of current economic uncertainties. This rejection could signify a growing trend among institutional investors who are becoming increasingly vocal about executive pay structures.

Tesla is not the only company navigating these turbulent waters. Rivals in the electric vehicle (EV) market, such as Rivian Automotive ($RIVN) and Lucid Motors ($LCID), are also under scrutiny as they attempt to carve out their respective niches in a rapidly evolving industry. With the increasing competition, the decisions made by leadership teams at these companies will be critical in shaping their financial futures.

Additionally, the broader tech sector is feeling the effects of rising Treasury yields and a stronger dollar, which can impact growth stock valuations. Companies like Palantir Technologies ($PLTR), which recently saw a drop in stock price following earnings reports, may also experience increased volatility as investors reassess their positions in light of macroeconomic factors. The tech-led selloff suggests that investors are becoming cautious, perhaps influenced by the uncertainty surrounding major players like Tesla.

As we move forward, it will be essential for investors to keep an eye on how these developments unfold. The interplay between executive compensation, market trends, and investor sentiment will undoubtedly shape the landscape of not only Tesla but the wider tech and automotive sectors.

In conclusion, the recent rejection of Musk's pay deal highlights a critical moment for Tesla and its investors. As we continue to navigate these changes, staying informed about company strategies and market shifts will be vital for making sound investment decisions.

Read more: Major Tesla Investor Rejects Elon Musk’s $1 Trillion Pay Deal Stock Market Today: Nasdaq Futures Drop in Tech-Led Selloff Denny’s to Go Private in $322 Million Deal