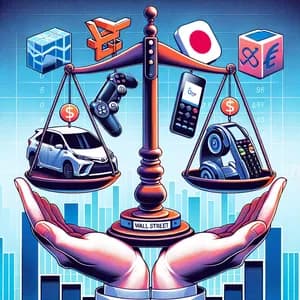

Tariffs & Stocks: Key Insights for Savvy Investors

Navigating the Impact of Tariffs: Insights for Stock Investors

As tariffs continue to shape the economic landscape, stock investors must remain vigilant about their implications on various sectors. Recent discussions have highlighted the challenges and opportunities that arise from tariff-induced market fluctuations. Here, we delve into how some key companies are navigating this terrain, particularly in the financial services and technology sectors.

The Ripple Effect of Tariffs

The financial services sector is currently experiencing a nuanced response to tariff-related pressures. Major players like Bank of America ($BAC) and Citigroup ($C) reported an uptick in consumer spending during the first quarter of 2025, despite growing economic concerns. This resilience suggests that consumers are adapting to economic conditions, which is a positive indicator for banks that thrive on transaction volumes and loan growth.

In the technology sector, Deutsche Telekom ($DTEGY) is also feeling the effects of these trade tensions. As a global telecom provider, the firm faces both opportunities and challenges from tariff impacts on its international operations. The company’s ability to navigate these complexities will be crucial as it seeks to maintain its market position amidst fluctuating trade policies.

Investigative Moves in the Market

Adding to the dynamic environment, Trump Media & Technology Group has requested an investigation from the SEC into alleged suspicious trading activities linked to a U.K.-based hedge fund, Qube Research & Technologies. This development raises questions about market integrity and transparency—critical factors for investors to consider when evaluating stock performance and potential risks.

The Natural Gas Landscape

In the commodities market, EQT Corporation ($EQT) has announced that its portfolio has limited direct exposure to tariffs. However, the company acknowledges that deteriorating market conditions will inevitably impact its exit strategy for investments. This insight is particularly valuable for investors focused on energy stocks, as shifts in policy and tariffs can have a profound effect on resource pricing and availability.

The Broader Context

Amidst these developments, U.S. Treasury yields have fallen, suggesting a calmer trading environment. Investors should keep an eye on how these changing yields could influence borrowing costs and investment strategies across sectors. With the 10-year Treasury yield recently declining to 4.322%, the implications for growth stocks, especially in tech and financials, cannot be ignored.

For stock investors, the evolving landscape brought about by tariffs presents both risks and opportunities. Staying informed about how key companies are adapting to these changes will be crucial for making informed investment decisions.

Conclusion

In conclusion, the interplay between tariffs, consumer resilience, and company-specific strategies will significantly shape the stock market in the coming months. As investors, keeping a close watch on companies like Bank of America ($BAC), Citigroup ($C), Deutsche Telekom ($DTEGY), and EQT Corporation ($EQT) will be essential to navigating this complex economic environment.

For deeper insights into these developments, you can explore the following articles:

- Trump Lashes Out at Powell, Says ‘Termination Cannot Come Fast Enough’

- Financial Services Roundup: Market Talk

- Tech, Media & Telecom Roundup: Market Talk

By staying informed, investors can better position themselves to capitalize on opportunities and mitigate risks in this ever-evolving market landscape.