Stocks Skid as Trade War Fears Resurface: Key Insights for Investors

U.S. Stocks Tumble as Trade-War Jitters Return: What Investors Need to Know

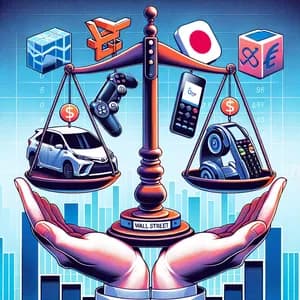

The financial markets have recently experienced turbulence as trade-war jitters return, leading to a significant pullback in U.S. stocks. The Dow industrials and S&P 500 indices surrendered some of the gains achieved during Wednesday’s historic rally, leaving investors concerned about the overall market direction. As stock investors navigate this uncertain landscape, it's crucial to understand the implications of these developments and how they may affect several key companies.

Key Companies to Watch:

- Apple Inc. ($AAPL): As one of the largest tech companies, Apple is particularly sensitive to international trade policies. With a significant portion of its supply chain based in China, any escalation in trade tensions could impact production costs and profit margins. Investors should keep an eye on how changes in tariff policies affect Apple’s stock price.

- Caterpillar Inc. ($CAT): Known for its heavy machinery and equipment, Caterpillar relies on global trade for its revenue. The company has expressed concerns over trade tariffs, which could affect demand for its products. A slowdown in international construction projects due to trade uncertainties could impact Caterpillar’s earnings, making it a pivotal stock to monitor in these turbulent times.

- Boeing Co. ($BA): As a major player in the aerospace industry, Boeing's fortunes are closely tied to international trade relations. The company has faced challenges stemming from trade disputes, particularly with China, its biggest market for aircraft exports. With the return of trade-war jitters, Boeing's stock may be at risk as investors reassess the potential impact on future orders.

- Ford Motor Company ($F): The automotive giant Ford is also feeling the heat from trade tensions, particularly with tariffs on steel and aluminum. Given that the automotive industry is highly competitive and sensitive to input costs, Ford's ability to manage these challenges will be critical for its stock performance.

- Johnson & Johnson ($JNJ): As a global healthcare company, Johnson & Johnson operates in numerous markets affected by trade policies. While not as directly impacted as other sectors, fluctuations in currency exchange rates and supply chain disruptions can influence J&J's profitability. Investors should remain vigilant about how broader economic conditions affect this healthcare giant.

- Visa Inc. ($V): As a leader in the payments sector, Visa's performance can be influenced by consumer spending habits, which may be affected by economic uncertainties stemming from trade policies. A downturn in consumer confidence could lead to decreased transaction volumes, affecting Visa's revenue.

As investors grapple with the implications of renewed trade tensions, it’s essential to stay informed about the broader market dynamics and how they impact individual stocks. Understanding the interplay between policy changes and company performance will be key to making informed investment decisions.

For those looking for more insights into the recent market developments, you can read further about the situation here:

- U.S. Stocks Tumble as Trade-War Jitters Return

- Trump U-Turn Halts the ‘Sell Everything American’ Trade, but the Fallout Remains

Stay tuned and keep your portfolios well-adjusted in these uncertain times!