Schrödinger's Stock Market: Decoding United Airlines' Earnings Paradox

Welcome to Schrödinger’s Stock Market: Navigating Uncertainty in Earnings Guidance

In the unpredictable world of stock investing, the recent earnings guidance from United Airlines has left many investors scratching their heads. Dubbed “Schrödinger’s Stock Market,” this situation presents a paradox where the company appears to be both thriving and struggling at the same time, reflecting the broader uncertainties that can influence market dynamics.

United Airlines Holdings Inc. ($UAL) has made headlines with its conflicting earnings guidance, raising questions about the reliability of corporate forecasts. This duality not only affects investor sentiment but also impacts the airline industry as a whole, influencing other players in the sector. Investors must now navigate the murky waters of varying expectations and market reactions.

The Airline Industry's Ripple Effect

United is not alone in facing challenges. Delta Air Lines Inc. ($DAL) and American Airlines Group Inc. ($AAL) are also grappling with the impact of shifting consumer behavior and rising operational costs. As airlines strive to recover from the pandemic's effects, any signs of volatility can trigger broader market reactions, making it crucial for investors to stay informed.

The Broader Market Context

This phenomenon of mixed signals is not limited to the airline industry. Other sectors are also experiencing similar bewilderment. The semiconductor industry, for instance, faces its own set of challenges. Companies like NVIDIA Corporation ($NVDA) and Advanced Micro Devices, Inc. ($AMD) have been riding the AI wave, but the increasing reliance on a single technology raises concerns about overexposure. With geopolitical tensions and trade wars looming, investors must assess the risk associated with these companies' heavy dependence on AI developments.

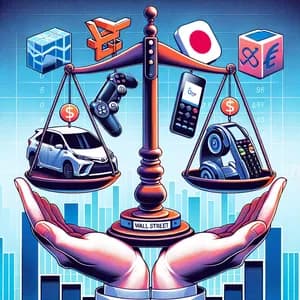

The Importance of Diversification

In light of these complexities, diversification remains a key strategy for investors. While United Airlines navigates its earnings uncertainty, considering investments in companies across various sectors can mitigate risks. For example, while tech stocks like Apple Inc. ($AAPL) and Microsoft Corporation ($MSFT) may offer stability, the energy sector, represented by firms like NextEra Energy, Inc. ($NEE), provides a counterbalance, particularly as the world shifts towards renewable energy sources.

Conclusion

As we continue to see market fluctuations driven by conflicting signals and broader economic uncertainties, stock investors must remain vigilant. The situation with United Airlines serves as a reminder of the importance of thorough research, diversification, and adaptability in investment strategies. Keeping an eye on earnings guidance and understanding the interconnections within various industries will be critical in navigating this complex landscape.

For those interested in exploring this topic further, you can read more about it in the following articles:

- Welcome to Schrödinger’s Stock Market

- Financial Services Roundup: Market Talk

- The Chip Industry Has Too Many Eggs in the AI Basket

Stay informed and make wise investment choices!