Market Surge: Trade Optimism Fuels Stock Gains and Investor Confidence

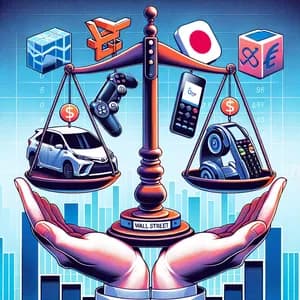

Hopes on Trade and Economy Drive Stock Market Gains

In a week marked by optimism regarding trade and economic growth, the U.S. stock market experienced significant gains, with the S&P 500 closing higher for an impressive ninth consecutive day. This rally is largely attributed to positive developments in trade negotiations and encouraging economic data, which have bolstered investor sentiment.

One of the key players in this market surge is Apple Inc. ($AAPL). The tech giant has consistently demonstrated resilience and innovation, making it a favorite among investors. Recent reports suggest that Apple is poised to expand its product offerings, which could further enhance its revenue streams and solidify its position in the market.

Another significant contributor to the market's upward momentum is Amazon.com Inc. ($AMZN). As consumers increasingly turn to e-commerce, Amazon continues to capture a larger share of the retail market. Recent earnings reports have highlighted robust growth in its cloud services division, AWS, which is a major driver of profitability for the company.

Tesla Inc. ($TSLA) also plays a crucial role in the current market dynamics. With a growing focus on electric vehicles and sustainable energy solutions, Tesla's market presence is stronger than ever. The company's recent announcements regarding new models and expansion into international markets have energized investor confidence.

In the financial sector, Goldman Sachs Group Inc. ($GS) has been making headlines. The firm recently reported increased trading revenues, benefiting from heightened market activity. As a key player in investment banking, Goldman Sachs is well-positioned to capitalize on the current economic climate, making it an attractive option for stock investors.

Additionally, Standard Chartered PLC ($STT) has shown promising growth, recently posting a rise in quarterly profits. The bank has maintained its guidance despite cautionary notes about economic uncertainties, indicating a strong operational foundation that could appeal to investors looking for stability in turbulent times.

As the market continues to react to trade negotiations and economic indicators, investors should keep an eye on these companies, which are likely to be influenced by the evolving landscape. The combination of trade optimism and strong earnings reports could mean further gains ahead for stock investors.

For more insights on the current market trends and developments, check out the following articles: