Fed Meeting Today: How It Impacts Investors Amid Earnings Reports

Fed Meeting Today: What It Means for Investors

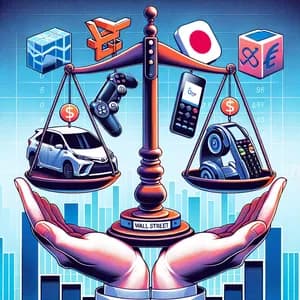

As stock investors, the Federal Reserve's decisions can have a significant impact on our portfolios. Today, the Fed is meeting, and anticipation is building—especially with earnings reports rolling in from major companies and the potential for changes in interest rates. With S&P 500 futures edging up, it’s essential to consider how these developments might affect your investments.

Earnings Season Insights

Earnings reports are a critical indicator of a company’s health and future performance. Today, investors are particularly focused on earnings from tech giants such as Microsoft ($MSFT), Meta Platforms ($META), and Qualcomm ($QCOM). These companies are not only leaders in their sectors but also significant players in the broader market, making their earnings reports especially important for gauging market sentiment.

- Microsoft ($MSFT): As a key player in software and cloud computing, Microsoft is expected to report strong earnings, driven by its Azure cloud services and Office 365 subscriptions. Any positive news here could bolster investor confidence in the tech sector.

- Meta Platforms ($META): Known for its social media dominance, Meta has been under scrutiny for its advertising revenue and user growth. Investors will be watching closely to see how the company navigates challenges and capitalizes on new opportunities in the metaverse.

- Qualcomm ($QCOM): As a leader in semiconductor technology, Qualcomm’s earnings will be indicative of the broader tech hardware sector's health. With the ongoing demand for 5G technology, a strong earnings report could signal continued growth in this area.

The Rate Decision in Focus

Alongside the earnings reports, the Fed's interest rate decision is in the spotlight. With inflation concerns lingering, many investors are speculating whether the Fed will opt for a rate hike. A change in interest rates can influence borrowing costs, consumer spending, and ultimately, corporate earnings.

As we await the Fed's decision, the market remains on edge, reflecting mixed sentiments as investors digest the potential impact of tariffs on earnings and overall economic health.

Conclusion

With earnings reports from giants like Microsoft, Meta, and Qualcomm, combined with the Fed's decisions on interest rates, today is crucial for stock investors. Staying informed about these developments can help you make better investment decisions and adjust your portfolio accordingly.

For more detailed insights, you can read the original news articles: